What is PAN Card

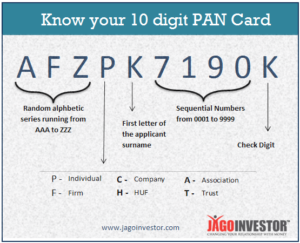

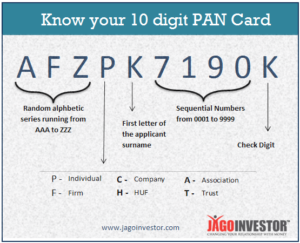

Permanent Account Number (PAN) is 10 digit alphanumeric numbers which is allotted by the Income Tax department to the person who applies for it. Fourth alphabet in the Pan card donates to which entity this Pan number is been allotted (For example- P-for Individual, F-Firm, etc.)

Types of PAN Applications

There are two types of PAN applications:

- Application for allotment of PAN: –This application form should be used when the applicant has never applied for a PAN or does not have PAN allotted to him. Applicant may visit ITD’s website www.incometaxindia.gov.in to find whether a PAN has been allotted to him or not.

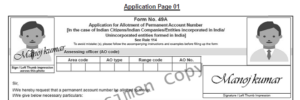

Following forms have been notified by ITD (w. e. f. November 1, 2011) for submitting applications for allotment of new PAN:

FORM 49A: – To be filled by Indian citizens including those who are located outside India.

FORM 49AA: – To be filled by foreign citizens.

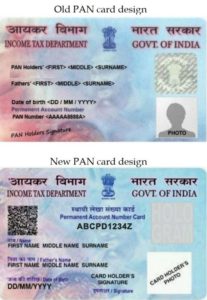

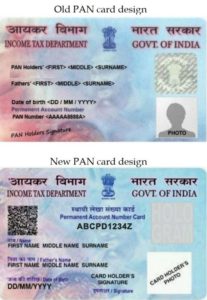

- Application for new PAN Card or/and Changes or Corrections in PAN Data: –Those who have already obtained the PAN and wish to obtain the new PAN card or want to make some changes / corrections in their PAN data, are required to submit their applications in the following form prescribed by ITD. There are times when by mistake the details of an entity may get wrongly printed on PAN card or may get wrongly stored in the information database of the Income Tax Department. Any such discrepancy in data can be corrected using the correction and modification option provided by the IT department. For women in India, there are times when they change their name after marriage and such want a new identity proof to be issued. Such situations too require change in PAN details and as a result a fresh PAN with new card details is issued to the applicant. A new PAN card bearing the same PAN but updated information is issued to applicant in such case.

- Application for reprint of PAN card: A case for reprint of PAN arises when an entity loses PAN card. This might happen due to theft, misplacement or any natural calamity. In such situations, an application for reprint of PAN needs to be submitted. Reprint of PAN takes your previous PAN card copy or acknowledgement copy as reference and verifies it to issue a fresh PAN card to the applicant. In this case, only the card issued is new while the details on the card are exactly the same as before.

Who needs to apply for the PAN

Request to allot new PAN or request for correction/reprint of PAN card can be done by Individuals, HUFs, Trusts, Corporates-Companies, Organizations, Firms, Local Authorities, Governments, Minors, and Senior Citizens etc. When any person needs to pay taxes or carry out any transaction that mandates the use of PAN information he must mandatorily apply for Pan, one can also apply voluntarily.

How to Apply

Applicant may either make an online application submit physical PAN Application. Applicants should go through the instructions and guidelines provided in the application form before filling the form.

Documents Required

Applicant should ensure that the necessary supporting documents (as specified under Rule 114 of Income Tax Department) are submitted along with the application. The details of the documents required are also provided in the website www.groupsofsj.com . Name mentioned in Application form and Name in the Proof of Identity /Proof of Address should match exactly.

Where to get the Physical Application Forms

Applicants may obtain the application forms from TIN-FCs, PAN centres, any other vendors providing such forms or can freely get the same from our website.

Communication

Application details to ITD are forwarded after digitization of the form submitted.

In case of application for allotment of PAN (Form 49A), a new PAN is allotted by ITD. NSDL prints the PAN card after allotment of PAN by ITD and dispatches the same along with an allotment letter to the respective applicant.

In case of ‘Request for New PAN Card or/and Changes or Correction in PAN data’ the application request is forwarded to ITD for update of the database and after confirmation from ITD, a new PAN card is printed and dispatched to the applicant.

All the communications are sent at the address mentioned as ‘address for communication’ in the form. Applicants, specifying valid e-mail ID in the application, are informed about the new PAN through e-mail in addition to the PAN allotment letter. Applicants are advised to mention their telephone number (preferably a mobile number) in the application. This ensures faster communication in case of any discrepancy in the application.

PAN Applications by Non Resident Indians

Online PAN application for foreigners also follows similar guidelines as for resident Indians. However, the application form that needs to be filled and submitted is form 49AA. Foreigners who hold business or financial transactions in the country need to furnish PAN details and hence PAN card becomes an essential document for foreigners in India too. All foreign directors and those who hold business positions as part of Indian subsidiaries are required to have an Indian PAN regardless of their location (in or out of India).

Status Track

The applicants may track the status of their application using 15 digit unique Acknowledgment Number after three days of application using the status track facility. Alternatively, applicant may call TIN Call Centre on 020 – 2721 8080 to enquire about the status of application. The status of the PAN application can also be tracked by sending an SMS – NSDLPAN your 15 digit acknowledgement number to 57575.

Fee

If the communication address is within India, the fee for processing of PAN application is 110 ( 93 +18% Goods And Services Tax).

If communication address is outside India, then the fee for processing PAN application is 1020 [(Application fee 93.00 + Dispatch Charges 771.00) + 18% Goods and Services Tax].

How Soon a PAN Card is dispatched

Normally 15 days are required to process the application, provided application is found to be in order (25 days in case of CR).

HIGHLIGHTS WITH EFFECT FROM 05/12/2018

- If you are going to apply for PAN on or after December 5, 2018, then you will not be required to mandatory quote father’s name in the application form in case mother being a single parent.

- Non-individual entities conducting transactions of Rs 2.5 lakh or more in a single financial year will now have to mandatory get PAN before May 31 of the next financial year.

We will like to share some more valuable tips with you.

Feel free to reach us @ 9832085358 / 9831564005 / info@groupsofsj.com / www.groupsofsj.com

If you like this idea do share and like the link: https://www.facebook.com/BusinessComfort/

Your comment on the article is welcome and we will love to hear from you.