Overview

TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons who are responsible for deducting or collecting tax. Under Section 203A of the Income Tax Act, 1961, it is mandatory to quote Tax Deduction Account Number (TAN) allotted by the Income Tax Department (ITD) on all TDS returns.

Since last few years ITD has revised the structure of TAN. It is a unique 10 digit alphanumeric code. Accordingly, they have issued TAN in this new format to all existing TAN holders.

To facilitate deductors find their new TAN, ITD has now introduced a search facility in their website (www.incometaxindia.gov.in). Through this facility deductors can search on their name and old TAN to find the new TAN. Deductors are advised to find the new TAN from this site before it is incorporated in their e-TDS return file to avoid any inconvenience at the time of furnishing e-TDS return.

Types of TAN Applications

There are two types of TAN applications:

This application form should be used when the deductor has never applied for a TAN or does not have a TAN.

This application form should be used when the deductor has a TAN and wants to make any change or correction in the data.

How to Apply

An applicant will fill Form 49B online or offline and submit the form. If there are any errors, rectify them and re-submit the form. Applicants should go through the instructions and guidelines provided in the application form before filling the form.

Who needs to Apply

| Persons authorised to apply and make credit card / debit card / net banking payment for other categories are as below: | |||||||||||||

|

|||||||||||||

Where to get the Physical Application Forms

Applicants may obtain the application forms from TIN-FCs, any other vendors providing such forms or can freely download the same from our website.

Communication

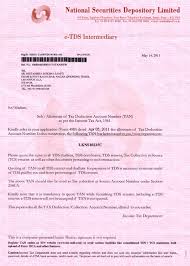

These applications are digitised by NSDL and forwarded to ITD. ITD will issue the TAN which will be intimated to NSDL online. On the basis of this NSDL will issue the TAN letter to the applicant.

Status track

The applicants may track the status of their TAN application using 14 digit unique Acknowledgment Number after three days of application using the status track facility. Alternatively, applicant may call TIN Call Centre on 020 – 2721 8080 to enquire about the status of application. The status of the TAN application can also be tracked by sending an SMS – NSDLTAN to 57575.

Fee

The processing fee for the both the applications (new TAN and change request) is 65 (including Goods and Service Tax).

We will like to share some more valuable tips with you.

Feel free to reach us @ 9832085358 / 9831564005 / info@groupsofsj.com / www.groupsofsj.com

If you like this idea do share and like the link: https://www.facebook.com/BusinessComfort/

Your comment on the article is welcome and we will love to hear from you.

It?s hard to come by knowledgeable people on this subject, however, you

Thank you for your whole hard work on this web page. My daughter really loves working on research and it’s really easy to understand why. My spouse and i learn all about the lively medium you create insightful tactics on this blog and therefore encourage participation from others about this point plus our favorite princess is really starting to learn so much. Take advantage of the rest of the year. You are always carrying out a splendid job.